What New Legislation Means In One State

What New Legislation Means In One State

by Ravelle Smith, JD of Cordell & Cordell, PC

There are several things the courts can consider when determining to deviate from the basic child support obligation.

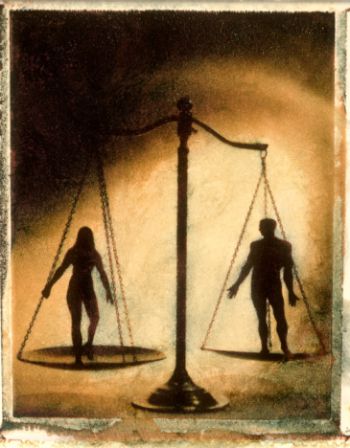

Many people have the misconception that the Georgia child support laws were changed to be more beneficial to men. This is a common misconception that I often her from clients as they enter a custody matter. In fact, the law wasn’t changed to per se be more beneficial to men or women, however it was altered in an effect to be fair and equitable to both parties in respect to their financial incomes.

Before 2007, in order to determine the child support due to a custodial parent, the court’s would take a certain percentage (based on the number of children) of the non-custodial parent’s gross income. Now, the child support guidelines take into account not only one person’s income for the determination of an award, but both parent’s income are used to derive the basic child support obligation due to the custodial parent. A determination of the parties’ income is typically where one would begin in a child support case. Income includes salary, commission, bonuses, fringe benefits, interest income, dividend income, civil judgments, gifts, and the like. Once the incomes of the parties is determined, it is inserted into Schedule A of the Child Support Worksheet.

Pursuant to O.C.G.A. §19-6-15, the Georgia legislature has stipulated the amount it takes to raise children given the parties’ combined gross income. For example, if Mom earns $3,000 per month, and Dad earns $4,000 per month, the lawmakers have determined that the amount to support one child is $1,067 between both parents. This amount can be found within the child support code section, which lists the obligation for parents up to the combined income reaching $30,000 per month. After that amount, it is within the court’s discretion to raise the obligation between both parents. However, in the example above, with a combined gross income of the parties reaching $7,000, the amount that the parents would be obligated to support their child is $1,067. The custodial parent would typically have to pay nothing since they have the child with them a majority of the time. The non-custodial parent would be obligated to pay his pro rata share of the $1,067. For instance, in the example above, Mom earns 43% of the gross income of the parties ($3000/$7000). Therefore, her portion of the child support would be 43% of $1,067, or $457. This would be Mom’s basic obligation for support.

Once the basic obligation for support is determined, it can be adjusted and deviated from. One should differentiate between the terms adjustment and deviation. Under the child support laws, the courts have a mandatory adjustment to the basic obligation for child support, while they have the discretion to deviate from the amount given a certain set of circumstances. The mandatory adjustment comes in Schedule D of the Child Support Worksheets. Schedule D accounts for costs incurred for health insurance and daycare. The statute provides that the child’s portion of their insurance premium (not vision or dental) has to be taken into consideration, and the basic child support obligation must mandatorily adjusted accordingly. In addition, the same must be done for child care costs incurred that are necessary for the parent’s employment, education or vocational training. The expenses must also be appropriate to the parent’s financial abilities and to the lifestyle of the child if the parents an child were living together.

Discretionary deviations appear in Schedule E of the Child Support Worksheets. The guidelines present a rebuttable presumption of the proper amount of child support in a case. These deviations provide the grounds under which you can rebut the presumptive amount of support. There are several things the courts can consider when determining to deviate from the basic child support obligation. Some of these expenses include private schools, life insurance, alimony paid, extraordinary education expenses, extraordinary medical expenses, etc. Parenting time is also another deviation the court’s can consider when altering the basic child support obligation. After all these factors are considered the court can either increase or decrease the amount of child support due to the custodial parent.

Litigants need to be aware in the beginning that the new guidelines do not necessarily mean that the obligating parent’s support will be less than it was under the old guidelines. You must consider that not only has the legislature established the basic amount of child support given the parent’s income, but if you have children that require day care or after school care, that amount must be reflected in the child support worksheets, and will automatically increase the obligation if that care is for the purposes of employment or education. Additionally, the basic child support obligation will be increased by inputting the amount spent on health care premiums for the children subject to the child support order. Therefore, while the basic child support obligation for a party may be less than what was required under the new guidelines, one should be reminded that these mandatory adjustments have to occur. Once you consider the mandatory adjustments, you must also be aware of the possible deviations that can be added to the child support obligation. In order to get a better grasp on the guidelines and the child support laws, go to http://www.georgiacourts.org/csc/ and familiarize yourself with the worksheets and information provided on the website. This should be a useful tool one can utilize when attempting to get a basic understanding of the obligations they face for the support of their minor children.

Ravelle Smith is an Associate Attorney and Litigation Manager in the Atlanta, Georgia office of Cordell & Cordell, P.C.

Ravelle Smith is an Associate Attorney and Litigation Manager in the Atlanta, Georgia office of Cordell & Cordell, P.C.

Read more about Mr. Smith.

my drivers license has been suspended since 2011 and I just found out my children are adults 26 and 28 live on there own in diffrent citys from their mother dont want the arrears owed mom doesn,t want arrears but wont call to have case closed. WHAT CAN I DO TO GET MY LICENSE REINSTATED? IM DISABLED AND ONLY GET SSDI COULDN.T PAY THE 5000.00 ARREARS IF SHE DID WANT THEM. HELP!!!

I am non-custodial parent who has paid the same amount of child support for one child for 14 years and always made substantially less income (as in half or more) of the custodial parents income. I have always paid about 16% of my gross salary every month in the years of 2002-present.

I have continued paying the same amount after the law changed in 2007. Am I entitled to receive money back that I have conceivably “overpaid” due to the law change?

how can this be?

What happens when a mother is trying to put man on child support who can not provide what the court is asking him. Due to the fact he takes care of other children who are not on child support. What happens if the father is going to school and only makes $80.00 a week yet has 2 women trying to put him on support will the Georgia court consider this or do they just act like the man only concern is pay for the children and not have a roof over his head. How can this be justified. Especially when neither one of the women allow the father to see the children because of feeling of resentment. How does it justify a man paying full wages for children he’s not allowed to see and does not have the money to fight tooth and nail to see his children. Please help me on this one. Georgia child enforcement do not seem right and i am a mother saying that.